Market Analysis: BTC, ETH & ETC

The evolution of the market during the past week was quite positive. Bitcoin is now trading just below the level of USD 23,500. What can we expect next? We’ll break this down later in the article but first, let’s go over the main industry news.

NEWS

News is one of the factors that impact cryptocurrency prices. It is important for every trader to stay up-to-date with the latest developments in the sphere. We’ve hand-picked some of the most interesting ones for you:

Will Ethereum Merge hopium continue, or is it a bull trap?

Ethereum is outperforming the broader cryptocurrency market as the highly anticipated Merge approaches, but the bigger picture is still largely bearish.

Ethereum (ETH) has gained a whopping 48% over the past seven days, outperforming its big brother Bitcoin, which has only managed to achieve 19% in the same period. It’s also up 66% from its market cycle bottom of $918 on June 19, reaching its current price of $1549.

However, the current Ethereum rally could be a bull trap with the macroeconomic clouds darkening. A bull trap is a signal indicating that a declining trend in a crypto asset has reversed and is heading upwards when it will actually continue downwards.

Source: https://cointelegraph.com/news/will-ethereum-merge-hopium-continue-or-is-it-a-bull-trap

Bitcoin’s longest ‘extreme fear’ streak finally breaks

Bitcoin (BTC) on Tuesday finally escaped the “extreme fear” zone after a whopping 73 days, coinciding with a 19% weekly increase in Bitcoin (BTC) as bulls make their way back to the market.

The Crypto Fear and Greed Index increased from “extreme fear” to merely “fearful” on July 19, reaching a score of 30 out of 100. It has gained slightly since then to the current index score of 31.

The Index analyzes the current sentiment of the overall crypto market, scoring between 0 to 100. The index is based mainly on Bitcoin market volatility, volume and dominance, social media sentiment, surveys, and search trend data.

Source: https://cointelegraph.com/news/bitcoin-s-longest-extreme-fear-streak-finally-breaks

Skybridge announces suspension of withdrawals from one of its crypto-exposed funds

Skybridge Capital has suspended withdrawals from its Legion Strategies fund – one of the firm’s funds with crypto exposure. Founder Anthony Scaramucci confirmed the move on Tuesday in an interview on CNBC after Bloomberg reported it a day earlier, citing anonymous sources.

“Our board made the decision to temporarily suspend until we can raise capital inside the fund,” Scaramucci told CNBC. “The fund is unlevered, so there’s definitely no fear of any liquidation whatsoever and about 18% of the fund is in what we would call crypto exposure.” An independent board also took part in the decision, Scaramucci said.

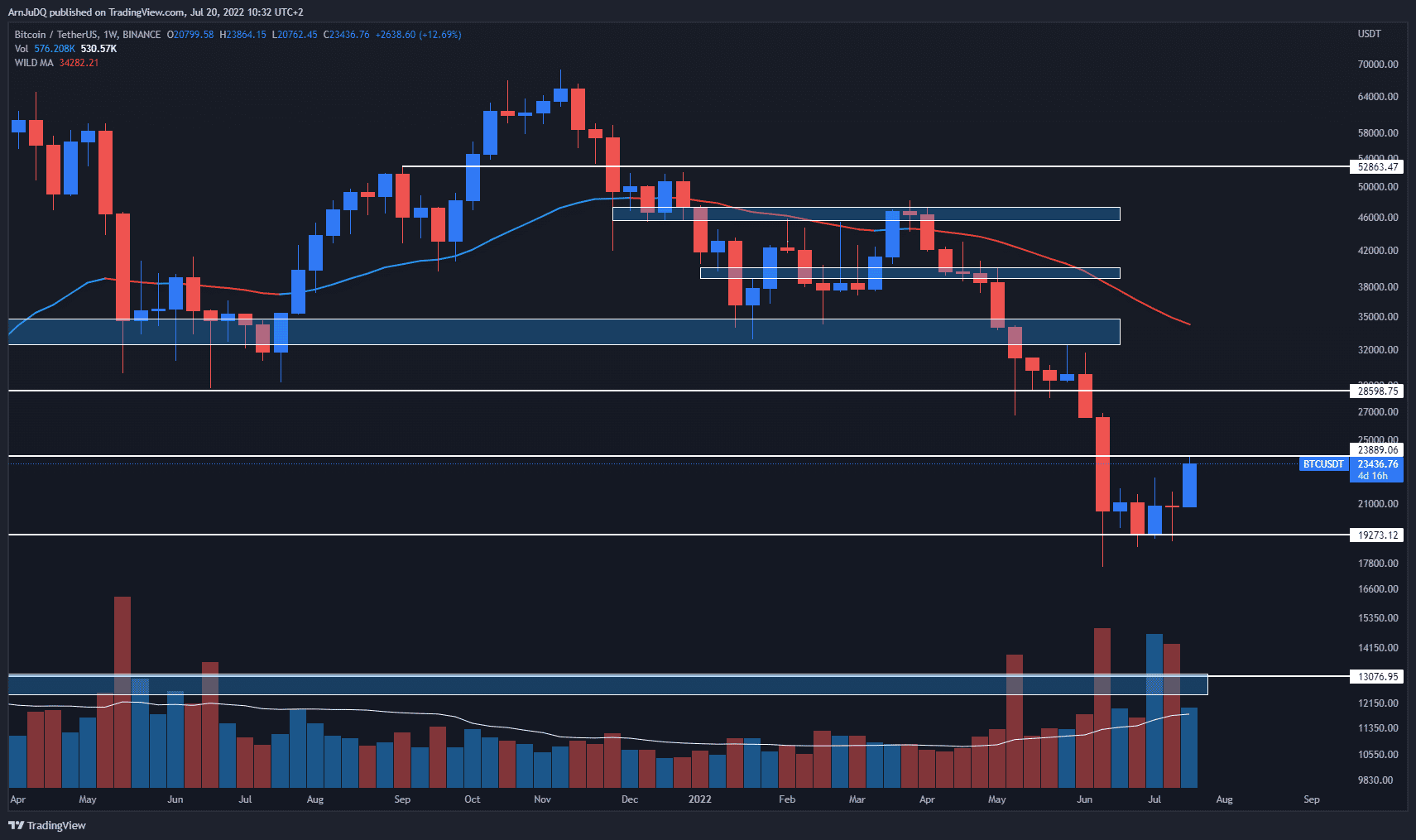

Bitcoin Analysis

Last week will have BTC once again testing the lower bound of its range at USD 19.200 but what we can see with the start of this one is a pretty significant rise and a BTC that now trades around USD 23.500.

We are now at a fateful moment for BTC, I have been telling you for weeks now that we absolutely must pass the USD 24,000 before opening any bullish position. Well, this is the moment of truth.

If we do break above this level, we should keep in mind that the USD 28,000 area could act as resistance.

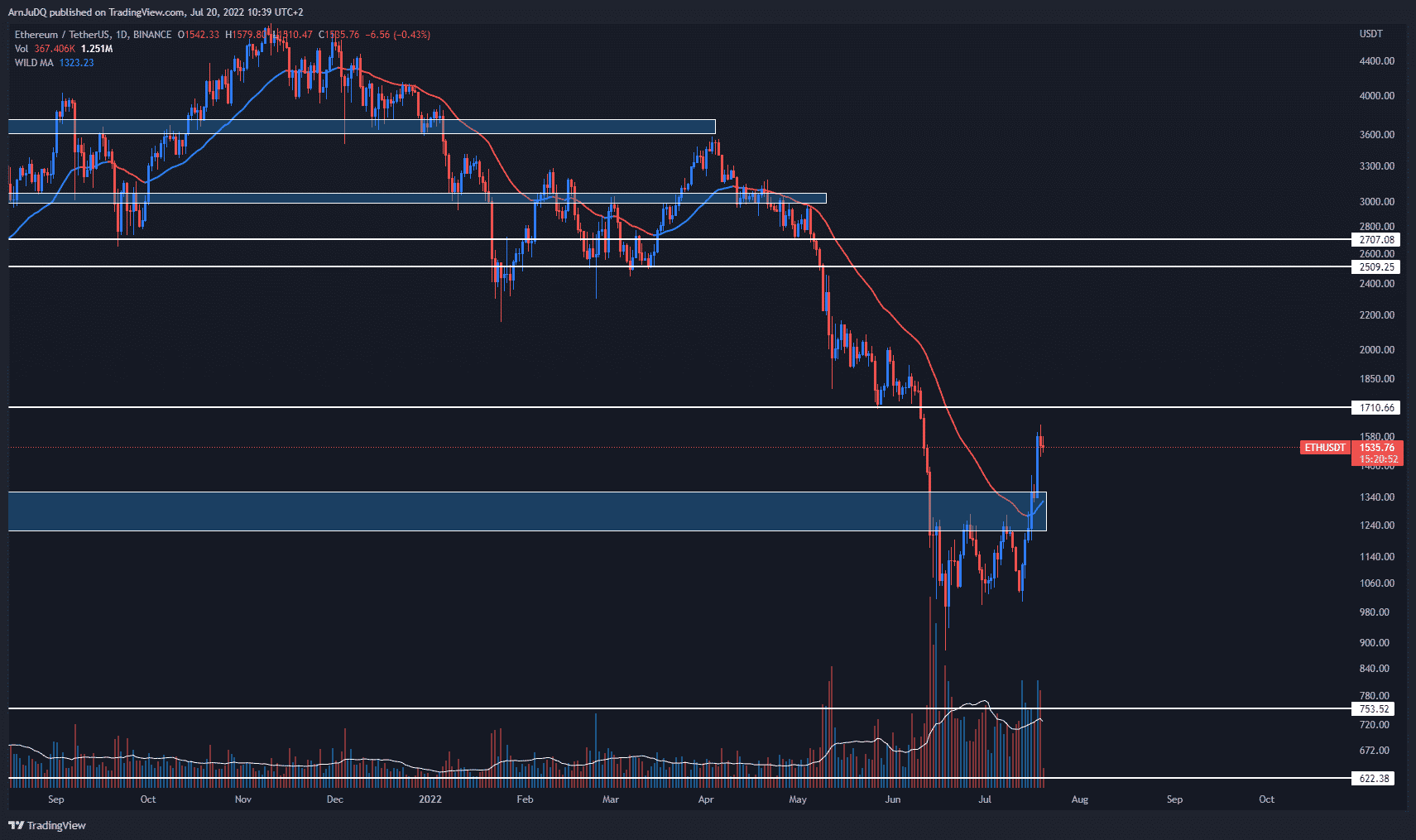

Ethereum Analysis

So if BTC had already rebounded well, it seems that for once it is not him who leads the dance but ETH. Indeed, Ethereum has appreciated by more than 50% since the last market update, which you will agree is quite impressive.

This has obviously something to do with the merge of its network and the small steps towards ETH 2.0. However, it would not be surprising to see ETH retest the USD 1.220 to USD 1.360 area after a possible test of the USD 1.700.

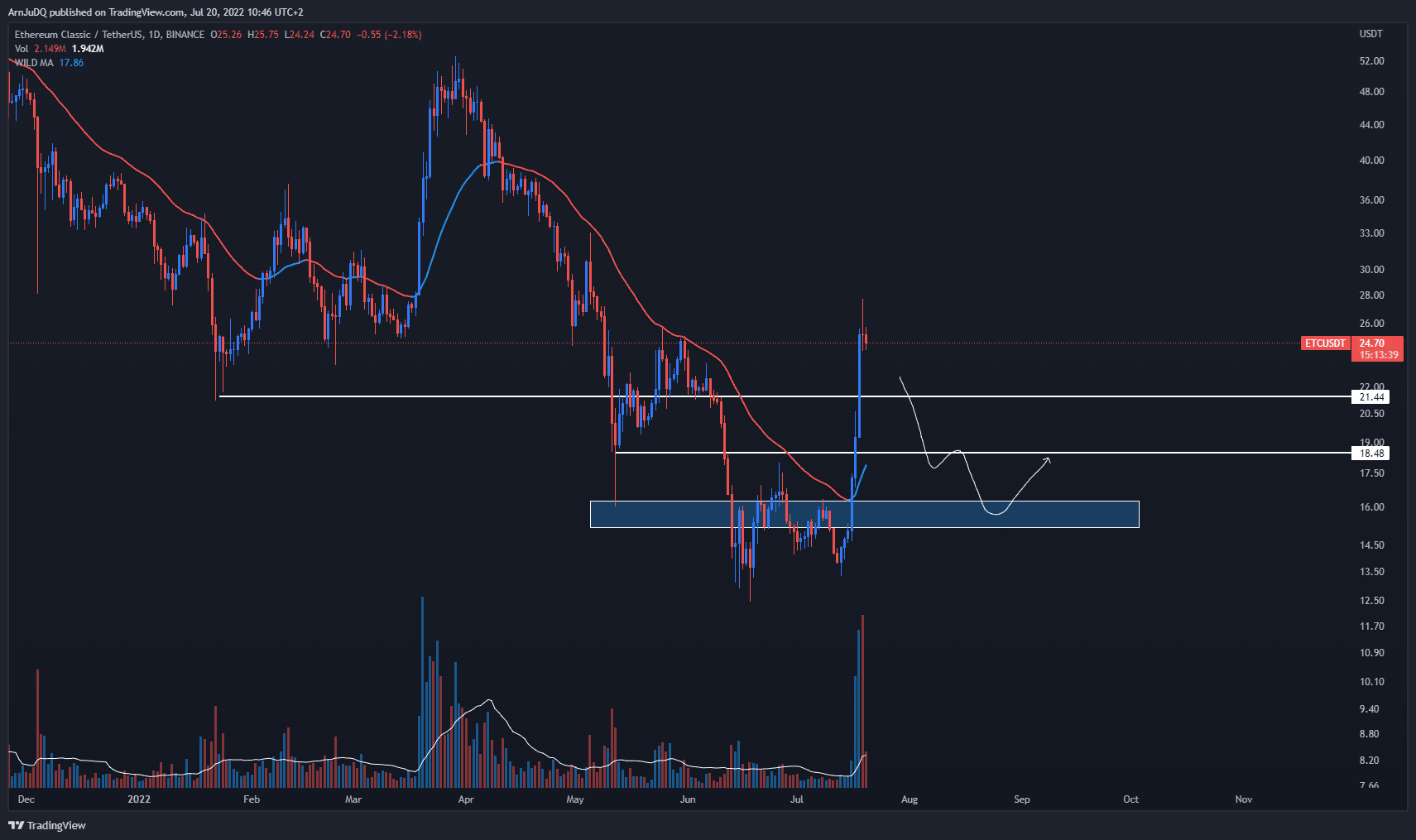

Altcoin of the week: Conditional long on ETC

The ETC/USDT pair has also seen a sharp upward trend over the past couple of days.

We will therefore open a retracement position around USD 16.35 to target a return to USD 15.50 first and USD 21.44 later.

In the meantime, be careful! Do not overexpose yourself, as usual.

Conclusion

Market sentiment can reverse very quickly on cryptos as we just saw this week again. Careful though, as long as we don’t have confirmation, we must base our decision on fact and for now we must be patient.

There is nothing more important for success in trading. Plan the trade and trade the plan! As simple as that. In fact, don’t be tempted to take dangerous positions and wait for confirmation.

I’ll see you next week, take care of yourself!

Have a great week everyone!